#1 Rated Residential and Commercial Claims Adjuster

Florida Public Adjusters:

Expert Claims Assistance for

Hurricane Helene & Milton

Your Insurance Company hired A Staff of Adjusters to Protect their

interest; which is why you should too.

Service Areas in Tampa, Florida

We proudly serve the following areas in Tampa: Wesley Chapel, Land O’ Lakes, New Tampa, East Tampa, West Tampa, South Tampa, Town & Country, Westchase, Temple Terrace, Brandon, Pinecrest, Lakeland, Seffner, Riverview, Apollo Beach, Gibsonton, Clearwater, St. Petersburg, Tarpon Springs, Spring Hill, Zephyrhills, and surrounding regions. Our dedicated team of public adjusters is committed to assisting residents throughout these communities with their hurricane claims and insurance needs.

call us on

1.877.274.3453about our company

Why Hire iFile Public Insurance Adjuster

Have you suffered a pipe leak, kitchen leak, bathroom leak, roof leak, HVAC leak, mold damage, fire damage, water damage, hail damage, lightning damage, sinkholes, commercial property damage, theft vandalism, storm or hurricane damage your home? Do you suffer from the consequences and you have no idea how to get a fair settlement to be able to repair your house?

Let us do your work. We inspect your home, analyze all the information and put together an estimate. Then we file the documents to your insurance company and negotiate your settlement.

Contact iFile Claims and your claim is going to be in good hands because we get the most out of it with our team of experts. With us, you never have to settle for less because we always make sure that you receive what you are entitled to under your policy.

More about us

Your Insurance Company, While Honest, Utilizes The Services Of An Employed Or Subcontractor Claim Adjuster

Your Insurance Company Will Send A Skilled Representative To Assess And Evaluate Your Property Loss. This Representative Is Employed By Your Insurance Company, Having Their Employer’s Best Interest In Mind. Their Goal Is To Settle Your Claim For As Little As Possible.

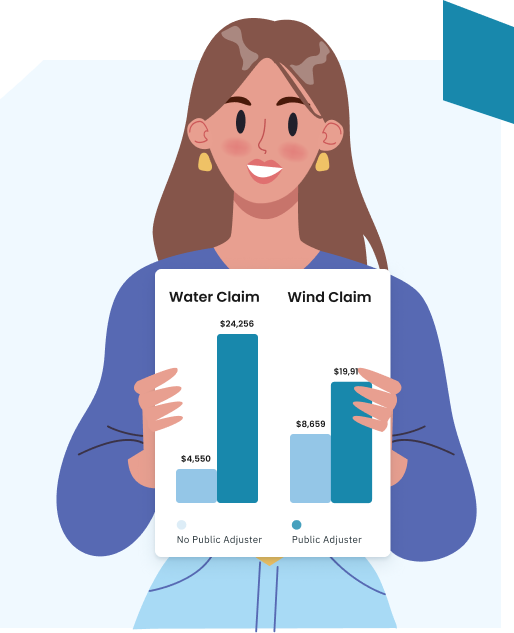

A Benefit Of A Public Insurance Claims Adjuster In Florida Is That They Add A Team Of Individuals To Your Side, And Help Even The Sides. Also Some Adjusting Groups And Firms May Have A Financial Interest In The Insurance Company They Represent.

“…Citizens Property Insurance Corporation Claims Data Found That Cases Took Longer To Reach A Settlement But Received Higher Payments When Claimants Used Public Adjusters For Claims Filed In 2008 And 2009. Public Adjusters Represented Policyholders In 26% Of Non-Catastrophe And 39% Of Catastrophe Claims Filed During This Period.

we are waiting for you

Contact us today

However your accident was caused, your claim can be reviewed by us free of charge.

or call us on

1.877.274.3453

our company

How can we help you

iFile Claims Public Adjusters are licensed professionals whose job is to advocate for you, the policyholder. In the state of Florida, these professionals can legally represent your rights during the insurance claim process. Why does everyone need that? Because insurance companies employ their own adjusters to settle your claim in the best interests of their company.

What does that mean?

The least money they give you, the better it is for them. This is when public adjusters come into the picture. These experts fight your fight to maximize your settlement. They help you every step of the way, so you don’t have to settle for less than what you deserve. After hiring iFile Claims you never have to pay out of your own pocket.

We operate on contingency, meaning if we are unable to recover from the Insurance Company there will be no fee assessed. We take all the risk by accepting no upfront fees, so it is in our interest to get you the best deal possible. That’s why we work restless to get you appraisals that can ensure a much better outcome for your claim

EXAMPLES OF

RESIDENTIAL CLAIM COVERAGES

COVERAGE A

DWELLING

Covers damages to Dwelling and the following:

COVERAGE B

OTHER STRUCTURES

Covers structures that are NOT attached to your home such as:

COVERAGE C

PERSONAL PROPERTY

Covers damage or loss to your personal property such as:

COVERAGE D

LIVING EXPENSES

Covers damages to living expenses:

EXAMPLES OF

COMMERCIAL CLAIM COVERAGES

COVERAGE A

DWELLING

Covers damages to Dwelling and the following:

COVERAGE B

OTHER STRUCTURES

Covers structures that are NOT attached to your home such as:

COVERAGE C

PERSONAL PROPERTY

Covers damage or loss to your personal property such as:

COVERAGE D

LIVING EXPENSES

Covers damages to living expenses:

our features

Why Choose Us

Free Policy Review

Are you confused about your Residential or Commercial Policy? Do you want to make sure your damages are covered by your insurance?

Taking a deeper look at your policy is always a good idea to avoid later uncertainty. We can review your policy for free.

Contact us today and our adjusters will get back to you shortly

Contact us today

1.877.274.3453Free Claim Consultation

If you don’t know what to do when a loss occurs. Contact iFile Claims Public Adjusters. We are here to help you. After you contact us, we’ll inspect your home, analyze all the information, estimate the costs and file the claim to your insurance company.

Do you have a new or an already open claim? Were you underpaid or denied? We can help in all cases. Ask for a free claim consultation now so we can start fighting your fight today.

Contact us today

1.877.274.3453Free Loss Inspection

If you need help identifying a fillable claim, whether its damage to a Roof, Plumbing, HVAC Systems, Water Heaters, Mold Issues, Fire Damage, Drywall Issues, Accidental Water Damage, Commercial Property Damage, Hurricane Damage, or more our Public Adjusters will inspect the loss for free.

We will also look for other damages, besides the one you requested, which could be also covered by your insurance. We offer Free Loss Inspection which is available upon request. Schedule your Free Loss Inspection Today

Contact us today

1.877.274.3453Schedule Your Free Inspection Now

Do you have a new or an already open claim? Were you underpaid or denied? Don’t worry, we can help you. In case the loss happened within 5 years, fill out our free inspection form, or send an email, and one of our public adjusters will contact you shortly.

You can also call us if that’s more convenient for you. Our team of experts (public adjusters, attorneys, contractors, mediators, engineers) is waiting for you to contact us.

Contact us today

1.877.274.3453Free Claim Denial Assistance

Are you unhappy with an underpaid claim? Did your insurance company deny your claim? It’s never too late within the 2 - 3 years period you are eligible to have your claim or claims reopened.

Fighting for a proper settlement is more than frustrating when it’s about repairing your home. Leave the fight to iFile Claims, and relax during the process. You can’t lose anything so why not reopening together today?

Contact us today

1.877.274.3453Free Claim Estimate

After hiring iFile Claims you will no longer have to worry about the cost of an Estimate. We provide Free complimentary professional estimates to clients in order to assist with their claim loss.

The cost of a Detailed Professional Estimate could range anywhere from $750.00 to $3,000.00, and an additional professional (Engineer, Contractor, & Architect) report may be required.

Contact us today

1.877.274.3453Free Virtual Inspection

Are you afraid in this insecure COVID period but still need our help? Don’t worry, we can inspect your home remotely. Contact our staff and sign up for our free virtual inspection.

Contact us today

1.877.274.3453Free Claim Evaluation

If you have a claim that has been filed and need help or don’t know what the next step is we can provide you with Free Claim Evaluation and let you know what to look out for or if we believe an expert is needed.

Contact us today

1.877.274.3453

To Get Started

To Get Started On The iFile Claims Process, Be Prepared To Provide The Following:

Policy Information

Name of insured, address, phone

number, e-mail, and policy number

Description of Loss

Everything you can recall can help us: time and date of the loss, location of the incident, a detailed description of damages (the more detailed, the better it is).

Emergency Service Companies & Damage Mitigation

In case you already contacted any emergency service companies or performed any sort of damage mitigation, please let us know.

Authority Notification

Note all authorities notified (e.g. fire department, police, etc.)

steps of our work

The iFile Claim’s Claims Process

Your insurance company will contact us when we can start our negotiation. Their plan is to give the least, but ours is to get the most out of your claim.

We never settle for less. After all the fights, pros and cons, when the deal has finally come to an end, your insurance company will send us the check that we will pass to you so your renovation can start

CLAIM DISCLAIMER

“Pursuant to Florida Statute 817.234, Any person who, with the intent to injury, defraud, or deceived any insurer or insured, prepares, present or causes to be presented a proof of loss or estimate of cost or repair of damaged property in support of a claim under an insurance policy knowing that the proof of loss or estimate of claim or repairs contains any false, incomplete or misleading information concerning any facts or thing material to the claim commits a felony of the third degree, punishable in S.775.082, S.775.803, or 775.084, Florida Statutes.

SOLICITATION DISCLAIMER

THIS IS A SOLICITATION FOR BUSINESS. IF YOU HAVE HAD A CLAIM FOR AN INSURED PROPERTY LOSS OR DAMAGE AND YOU ARE SATISFIED WITH THE PAYMENT BY YOUR INSURER, YOU MAY DISREGARD THIS ADVERTISEMENT

Our area

We Specialize in the following areas